Do you know how to calculate growth rate for your SaaS?

When there were fewer go-to-market strategies, the growth rate of a SaaS was far easier to calculate. A one-size-fits-all formula no longer works. To calculate the growth rate of your startup, you should take several different formulas into account. Some formulas will have more relevance to your SaaS than others - but it’s important to be aware of them all.

Founders have realized there’s more to growth than a growth rate. While you may fixate on improving your startup’s growth rate to secure more funding from top-tier investors, these investors perform data analysis at a much deeper level than simply cross-referencing how fast your ARR has grown. To succeed, you must know how investing teams measure SaaS growth.

With this in mind, our quick guide will break down different ways of evaluating SaaS growth. We will cover three formulas for measuring your growth rate and three different methods investing teams are using to evaluate growth. After reading this guide, you will have a good understanding of the various ways growth is being measured across the SaaS world.

How To Calculate Growth Rate (Formula)

There’s much more to calculating your growth rate than working out the percentage growth of your revenue. When you throw monthly, average trailing, or annual revenue into the mix, things don’t look so simple. As you begin to add various layers of complexity, you will see the need for more advanced formulas to effectively measure your SaaS growth rate.

Here are the three common formulas used by SaaS companies to measure their growth rate:

MRR (Monthly Recurring Revenue) Growth Rate

MRR Growth Rate = (End value of MRR – Start value of MRR / Start value of MRR) x 100

MRR is a great place to start. This enables you to measure the month-by-month progress of your SaaS company. You can think of this calculation as offering a high-level picture of your growth - measuring the increase or decrease in your monthly recurring revenue. When you look at your MRR growth rate, you can determine whether you’re ahead or behind schedule.

MRR growth rate considers expansions, contractions, and new revenue - showing how fast your SaaS is growing. While there are no clear benchmarks for the MRR growth rate of a SaaS business, there are some guidelines that you may wish to keep in mind. Tomasz Tunguz says an MRR growth rate of 15-20% is a good target for a post-seed/pre-series A startup to aim for.

NDR (Net Dollar Retention) Growth Rate

NDR = (Start value of MRR + Expansion & Upgrades – Contraction & Churn) / Start value of MRR) x 100

NDR is one of the best indicators of how SaaS companies meet the needs of their customers. If your NDR is above 100%, this means you’re generating more revenue with your existing user base than you’re losing from your customers. Typically, a high NDR is a positive indication that you have a sticky SaaS product and can often be directly tied to a value metric.

To break this down even further, Net Dollar Retention is a metric designed to measure the fluctuations within your existing revenue base. Focusing entirely on your existing pool of customers, this metric will show you how much growth has been achieved, regardless of whether you have managed to acquire any new customers and build up the user base.

NRG (Natural Rate Of Growth) Growth Rate

NRG = Annual growth rate x % Organic signups x % ARR from PLG x 100

Measuring the natural rate of growth is popular among product-led startups. NRG is a new way to understand the growth of a SaaS company. While very few companies are totally reliant on a product-led growth strategy, many are embracing a hybrid approach. For this reason, you will typically see NRG being utilized alongside a range of other growth metrics.

When the formula refers to organic signups, we’re talking about any signup you didn’t have to pay for. This means you should exclude customers that were acquired through paid ads and events. The annual growth rate is your MRR growth on an annual basis, which is your MRR for the current month, compared to the same month one year ago.

How Investors Measure SaaS Growth

CAGR (Compound Annual Growth Rate)

This is the mean annual growth rate of a SaaS company over a specified period of time longer than a single year. The metric is seen as one of the most accurate ways to calculate and determine the potential growth of a SaaS company. Venture capitalists use this metric to measure how fast a SaaS company is growing through the lens of either quarterly or yearly growth.

The Mendoza Line

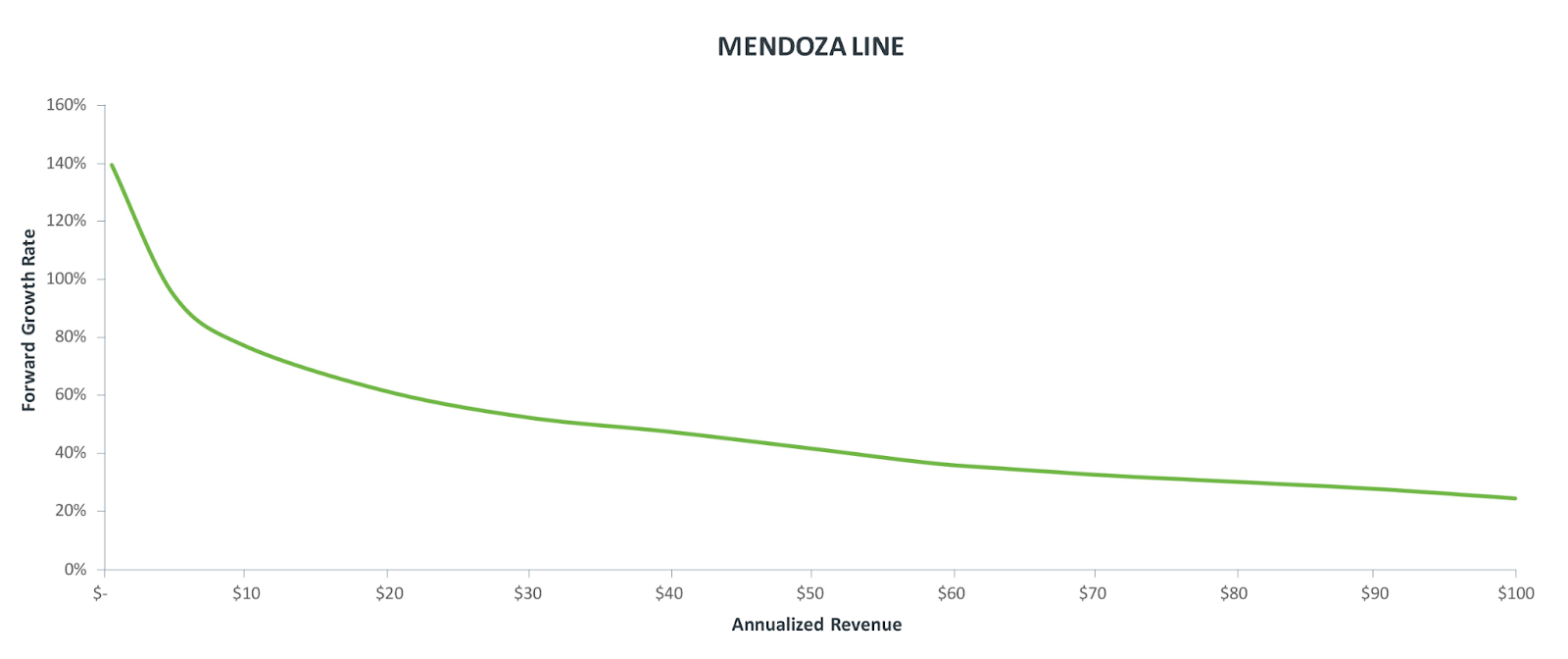

To capture the interest of a venture capitalist, how fast must you be growing? Rory O’Driscoll created a model called the Mendoza Line to define the minimum growth rate for a SaaS startup to be on track for an eventual IPO. By following this model, in every stage of a SaaS company’s life, you can see whether it is going in the right trajectory and has a venture-backable future.

Growth Decay

If you’ve just been through an early hyper-growth period, successfully increasing your growth rate for the following year can prove immensely challenging. Maintaining consistent growth over several years requires exceptional execution. As you can see from the chart below, very few recurring revenue companies are able to achieve growth rate acceleration at scale.

Venture capitalists know it’s challenging for recurring revenue companies to increase their growth rate. With this in mind, they will generate models like the one shown above to gain an understanding of how your SaaS company is performing. Typically, the growth rate in any given year will be predictive of the growth rate in the next.

If you’re looking for ways to boost your growth rate, you should start by getting the right systems in place to prevent churn and drive customer retention. Try Raaft for free today.

Offboarding Cheatsheet

This framework + video tutorial will help you design a better cancellation process.

Some of our featured articles

Adam Crookes

Adam Crookes

Customer Success insights in your inbox

Helping Founders and Customer Success Managers handle customer retention effectively.

We will only ever send you relevant content. Unsubscribe anytime.