Table of Contents

- What Has Happened To SaaS Valuations In 2025?

- 3 SaaS Valuation Metrics That Move The Needle & 1 Game-Changing Metric

- Why Do SaaS Valuations Actually Matter?

- The Growing Pains Of SaaS Companies In 2025

- Strong Customer Relationships Remain Vitally Important

- What Impact Do Sales Strategies Have On Valuations?

- What About Intellectual Property?

- Accurately Assessing Your SaaS Company's Value In 2025

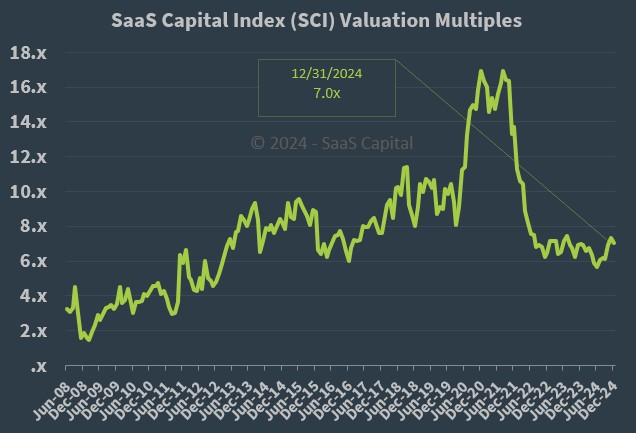

SaaS valuations between 2015-2023 were typically 5.1x revenue.

In 2025, the average SaaS enterprise value multiple is expected to be 6.0.

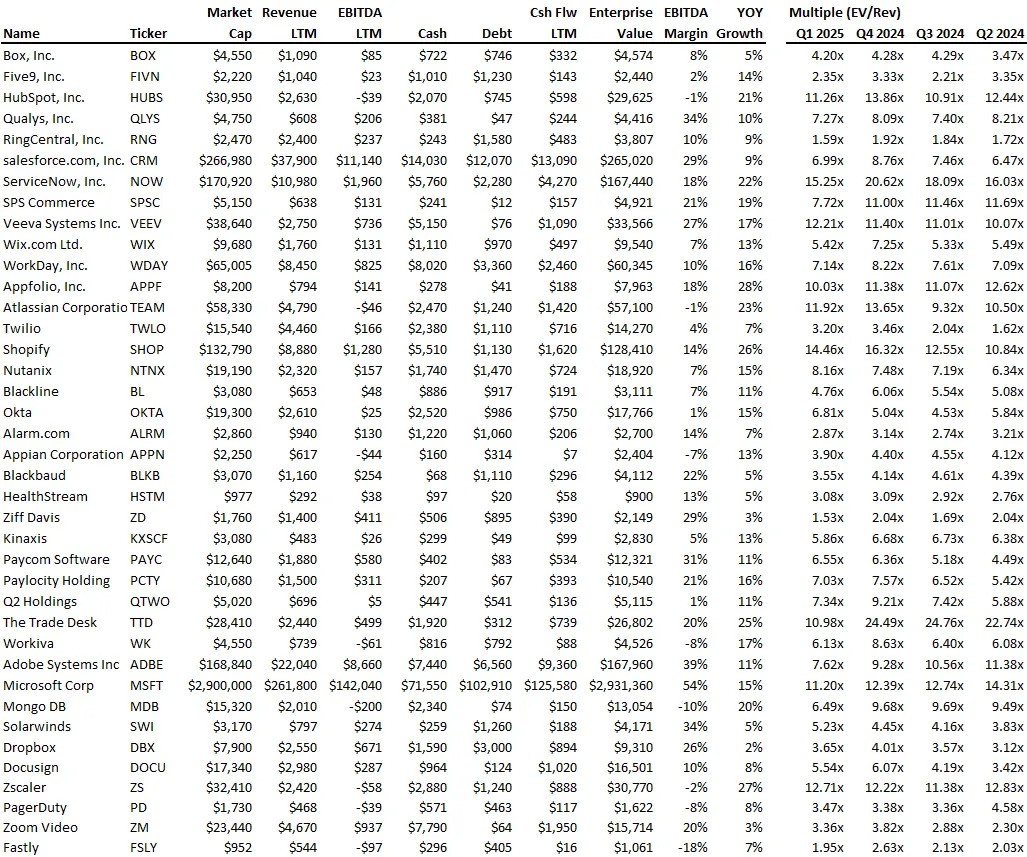

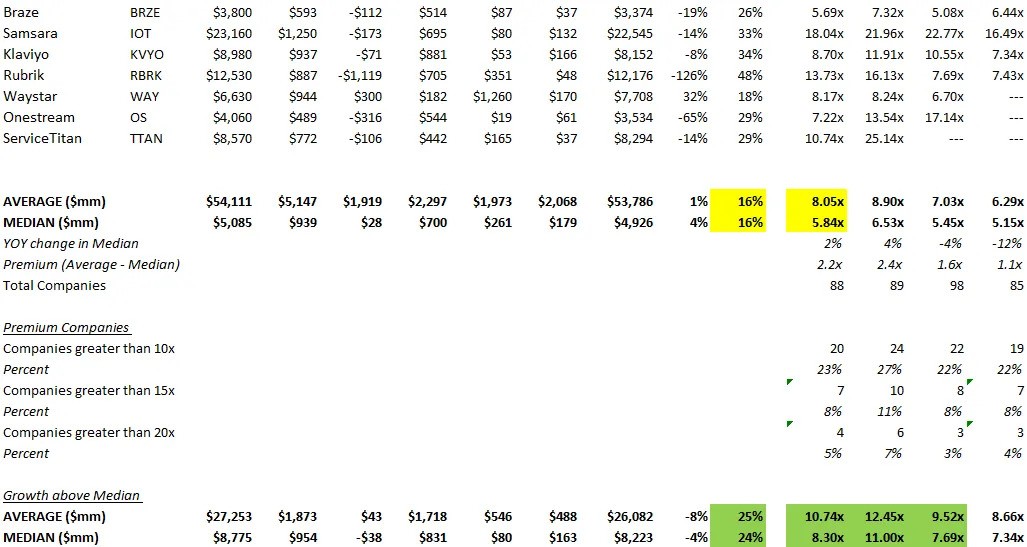

It’s now July 2025, and I’ve just read through some interesting insights from Sammy Abdullah on SaaS multiples in Q1 2025.

Of the 88 publicly traded SaaS companies Sammy follows, the median multiple was 5.84x revenue while the average was 8.05x.

Multiples for SaaS companies growing above the median of 16% are stronger: 8.30x on median and 10.74x on average.

So, what’s causing this?

Well, there are a few factors at play:

- Uncertainty caused by tariffs

- Lower interest rates

- Strong PE/VC dry powder

- Focus on profitability

- Monetary tightening

I’ve seen SaaS multiples shoot up and down depending on which way the economic winds are blowing.

As a SaaS founder are you:

- Struggling to understand why valuations skyrocketed one day and plummeted the next?

- Unsure whether to invest in that promising SaaS startup with explosive growth, or wait for the bubble to burst?

- Drowning in a sea of conflicting opinions and technical jargon, desperate for clear, actionable insights?

As a general rule, SaaS startups valued under $2 million can expect ARR (Annual Recurring Revenue) multiples between 5x to 7x revenue.

SaaS companies valued at over $2 million can expect ARR multiples between 7 to 10x.

The question is, if you were to try and sell your SaaS business right this second, what’s a fair price tag?

In this guide, we will break down everything you need to know about calculating SaaS valuations and how to calculate the right number for your SaaS business.

This article is for:

- Founders and CEOs of SaaS companies at all stages of growth.

- Investors considering backing the next big SaaS play.

- Anyone with a stake in the future of the cloud-based software revolution.

Let’s chart your journey toward a sky-high exit (or at least a comfortable landing).

What Has Happened To SaaS Valuations In 2025?

The SaaS valuation multiples we saw in 2020 have not returned, and probably won’t any time soon.

As Sammy Abdullah found, 23% of the companies he tracks are trading at 10x revenue or greater, whereas the peak was 60% in Q4 2020.

Four companies on his list trade above 20x, whereas 35 traded above 20x in Q4 2020.

The gap between the average and median is 2.2x, which means that premium SaaS companies are getting higher valuations.

However, that gap is tight relative to 2020 and 2021, when it was ~5.8x.

Here are some factors to consider:

Lower Interest Rates

As a SaaS founder, you're likely aware that lower interest rates make capital cheaper, which can lead to more investment in SaaS companies.

With lower rates on loans and bonds, investors find SaaS stocks and startups more attractive as they look for better returns than what's available in traditional fixed-income investments.

This environment could mean easier access to capital for growth or expansion, but it also requires you to manage your cash burn carefully to maintain profitability and attractiveness to investors.

Strong PE/VC Dry Powder

The term "dry powder" refers to the capital that private equity and venture capital firms have on hand, ready to invest.

For you, this means there's a lot of money looking for a home, potentially in your SaaS company if you can demonstrate solid growth prospects and a clear path to profitability or market dominance.

This environment can lead to competitive bidding for your company or favorable terms for funding rounds, but it also means you need to stand out with a compelling business model and execution strategy.

Focus On Profitability

In 2025, there's a shift in investor mindset from valuing growth at all costs to a more balanced approach where profitability matters significantly.

As a SaaS founder, this trend suggests that while growth is still crucial, showing a path to or already achieving profitability can significantly boost your company's valuation.

Investors are now looking for SaaS businesses that not only scale but also manage their unit economics well, ensuring that each customer adds more to the bottom line than they cost to acquire and serve.

This focus can push you towards operational efficiencies and perhaps a more conservative growth strategy.

Monetary Tightening

While lower interest rates might seem at odds with monetary tightening, what this means is that after a period of loose monetary policy, central banks might start to pull back on quantitative easing or raise rates to control inflation.

For you, this could mean that while capital might still be available, the cost of borrowing could increase, or investors might become more selective.

It's a signal to prepare your business for less favorable funding conditions by enhancing your company's operational efficiency, customer retention, and by solidifying your market position to weather potential economic shifts.

3 SaaS Valuation Metrics That Move The Needle & 1 Game-Changing Metric

I still believe several tried-and-true metrics impact the value of a SaaS company, including:

- Revenue growth

- Customer acquisition costs

- Customer lifetime value

Understanding how these metrics are calculated and how they impact your company's value is crucial for accurate SaaS valuation.

Revenue growth is an important metric in SaaS valuation because it reflects the business’s potential for future growth. The rate at which a SaaS company's revenue is growing can impact its value greatly, as it’s an indication of the company's ability to attract and retain users.

Investors and venture capitalists are attracted to high rates of revenue growth as it’s a clear indication that the SaaS company has a strong and growing user base.

Customer acquisition cost (CAC) is an interesting metric.

A reasonable price tag attached to the acquisition of each SaaS user is often a good way to prove that your business can grow with an injection of capital.

However, you must ensure customer acquisition costs are sustainable so that you do not run out of road further down the line.

The relationship between customer acquisition costs and customer lifetime value is critically important.

The cost to acquire a SaaS user should never outweigh their expected lifetime value.

If you can demonstrate the ability to acquire new users sustainably over the long term, you are likely to receive a favorable valuation.

Why Do SaaS Valuations Actually Matter?

Whether you want to attract investors or simply plan for the future, you must have a clear understanding of what your SaaS company is potentially worth.

You cannot automatically use the same ARR multiples as other SaaS companies.

I’ve seen is no shortage of variables come into play with SaaS valuations.

After all, no SaaS company is the same.

If you are serious about building a SaaS company that’s well-positioned for the future, you must get a handle on your numbers.

The Growing Pains Of SaaS Companies In 2025

The “grow at all costs” mentality, which often involves sacrificing profits and heavily reinvesting capital, doesn’t work in an unstable economic climate.

SaaS founders would raise a large sum of capital and invest it in user acquisition without worrying about whether or not they were actually turning a profit.

Many feel that this approach is no longer viable.

VCs enjoy adding SaaS companies to their portfolios as they provide predictable, recurring revenue.

However, they are increasingly looking for lean operations with healthy balance sheets.

From what I’ve seen, SaaS companies with low burn and long runways are getting the most attention from VCs.

If you are taking steps to address burn, this is also attractive to VCs.

To stay ahead of the competition, SaaS companies must understand their worth and know how to maximize it.

Ultimately, it all comes down to tracking a few key metrics that will determine your SaaS company’s value.

These metrics are of particular importance to venture capitalists who are interested in acquiring or investing in SaaS companies.

Strong Customer Relationships Remain Vitally Important

How sticky are your users?

When you acquire new users, do they stick around?

If you want to get a juicy SaaS valuation, you must keep user churn under control.

The relationships a SaaS company has with its users are critical to its overall value.

I’ve seen SaaS companies crash and burn because of an inability to get churn under control.

This doesn’t happen overnight.

It’s a slow and painful death.

If you cannot keep hold of your users and fail to inspire retention, your subscription base will essentially resemble a leaking bucket.

Sure, every SaaS company experiences churn - but there are different levels of churn.

The best thing you can do is continuously study the needs of your users and develop a SaaS product that’s exceptionally good at solving a persistent problem for a specific market.

What Impact Do Sales Strategies Have On Valuations?

Is your SaaS sales strategy scalable and sustainable?

Will this strategy enable you to continuously unlock monthly recurring revenue well into the future?

Naturally, sustainable sales and marketing strategies are very attractive to SaaS investors.

They want to see a clear path forward for continued revenue generation.

From the outset, your SaaS company should have a well-defined target market and a clear go-to-market strategy.

This makes it easier for you to acquire new users and increase your overall value.

Those are the basics.

I’ve found that former agency owners make surprisingly good SaaS founders.

Spending years in the B2B grind, they see client headaches repeat like clockwork, just begging for a software fix.

Their war wounds turn into winning SaaS ideas.

Many of the best SaaS companies begin by cornering and serving a niche market.

This enables them to grow very quickly.

But what happens next?

This is what VCs will want to know.

How are you going to expand beyond “niche domination” and capture a wide range of users at scale?

What About Intellectual Property?

Intellectual property, such as patents, trademarks, and copyrights, can also play a role in determining the value of a SaaS company.

If a SaaS business has strong intellectual property, this can itself create a competitive and help to increase the company's value.

Intellectual property can also help to protect the company's technology and offerings, which can reduce the risk for those interested in investing in the SaaS business.

Accurately Assessing Your SaaS Company's Value In 2025

When it comes to attracting investment, negotiating deals, and planning for the future, SaaS businesses must have a solid understanding of their worth.

As I’ve mentioned, there are many different factors to take into consideration.

In the data I referenced, it was found that the average revenue multiple for a SaaS company in 2025 is currently 8.05x.

You should not overlook the importance of keeping churn under control.

If your SaaS customer base resembles a heavily leaking bucket, this is a problem.

To get a solid valuation in 2025, here are some key action points for any founder:

- Tighten up your burn rate and get it under control.

- Consider how you will acquire users beyond your core market.

- Create a lean operation with a healthy balance sheet.

As you look to boost your SaaS valuation, I hope you find these pointers useful.

I’d also recommend reviewing your offboarding process with our SaaS offboarding cheatsheet.

This can help you reduce SaaS churn and make your SaaS more attractive to VCs.

Offboarding Cheatsheet

This framework + video tutorial will help you design a better cancellation process.

Some of our featured articles

Adam Crookes

Adam Crookes

Customer Success insights in your inbox

Helping Founders and Customer Success Managers handle customer retention effectively.

We will only ever send you relevant content. Unsubscribe anytime.